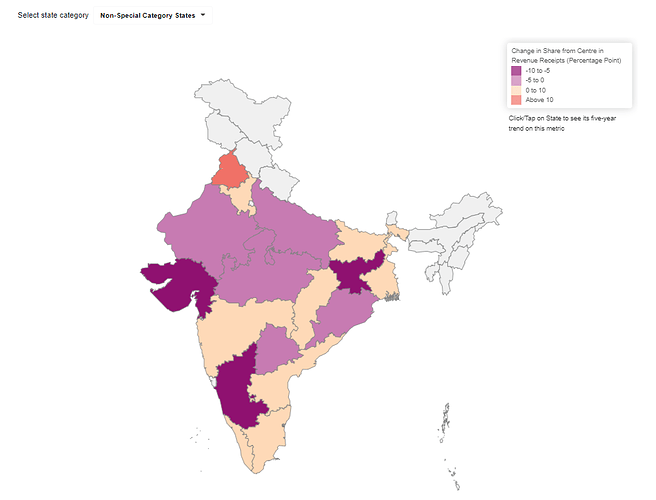

Between 2016-17 and 2021-22, states also have seen changes in the share of revenue receipts which comes from the Union government. This period also includes the changes brought on the recommendation of 15th Finance commission which was implemented in 2020-21.

This visualisation depicts the change in share of revenue receipts coming from centre in the 15th finance commission period (2020-21 and 2021-22) vs in the 14th finance commission period (2016-17 to 2019-20). Out of 25 states/UT for which data has been compiled, 16 have seen increase in the share of resources which comes from centre, while 9 have seen a reduction. Punjab and Uttarakhand have seen the largest increase while Karnataka and Jharkhand have seen the highest reduction.

@smukho, @anjana_r, @mnkgaur- How has the criteria for inter-state distribution of 15th FC Grants for local bodies changed from previous commissions? Has this had an impact on horizontal equity in the distribution of grants?